What are the total cost for buying a home in Malaysia?

Buying a home in Malaysia is a substantial financial undertaking, and it requires a comprehensive understanding of all associated costs to effectively budget for this major investment. In Malaysia, the total costs involved in purchasing a home extend beyond the simple price of the property. Initial expenses typically include the down payment, legal fees, stamp duties, and possibly agent fees. Additionally, there are ongoing costs to consider such as property taxes, maintenance fees, and insurance.

Understanding these fees in detail is crucial for prospective homeowners to ensure financial readiness. This breakdown helps in planning not only for the upfront costs but also for the long-term financial commitment involved in owning a property in Malaysia. By anticipating these expenses, buyers can manage their finances more effectively, avoiding unexpected burdens as they navigate the complexities of the property market.

Let’s break down the total costs involved in purchasing a home in Malaysia, covering both initial and ongoing expenses.

Initial Transaction Costs

1. Down Payment

The initial financial commitment when purchasing a home is the down payment, typically 10% of the property’s price. This is the part of the cost that cannot be financed through a loan.

2. Sale and Purchase Agreement (SPA) Costs

Legal fees for drafting the SPA are calculated as a percentage of the property price. This usually starts at 1% for the first RM500,000 and gradually decreases to 0.5% as the property value increases.

3. Stamp Duty on SPA

The Malaysian government levies a stamp duty on property transactions, tiered as follows:

- 1% on the first RM100,000

- 2% on the subsequent RM400,000

- 3% on the subsequent value

Starting in 2019, for first-time homebuyers, there is a stamp duty exemption on the first RM300,000 on homes priced from RM300,001 to RM1 million.

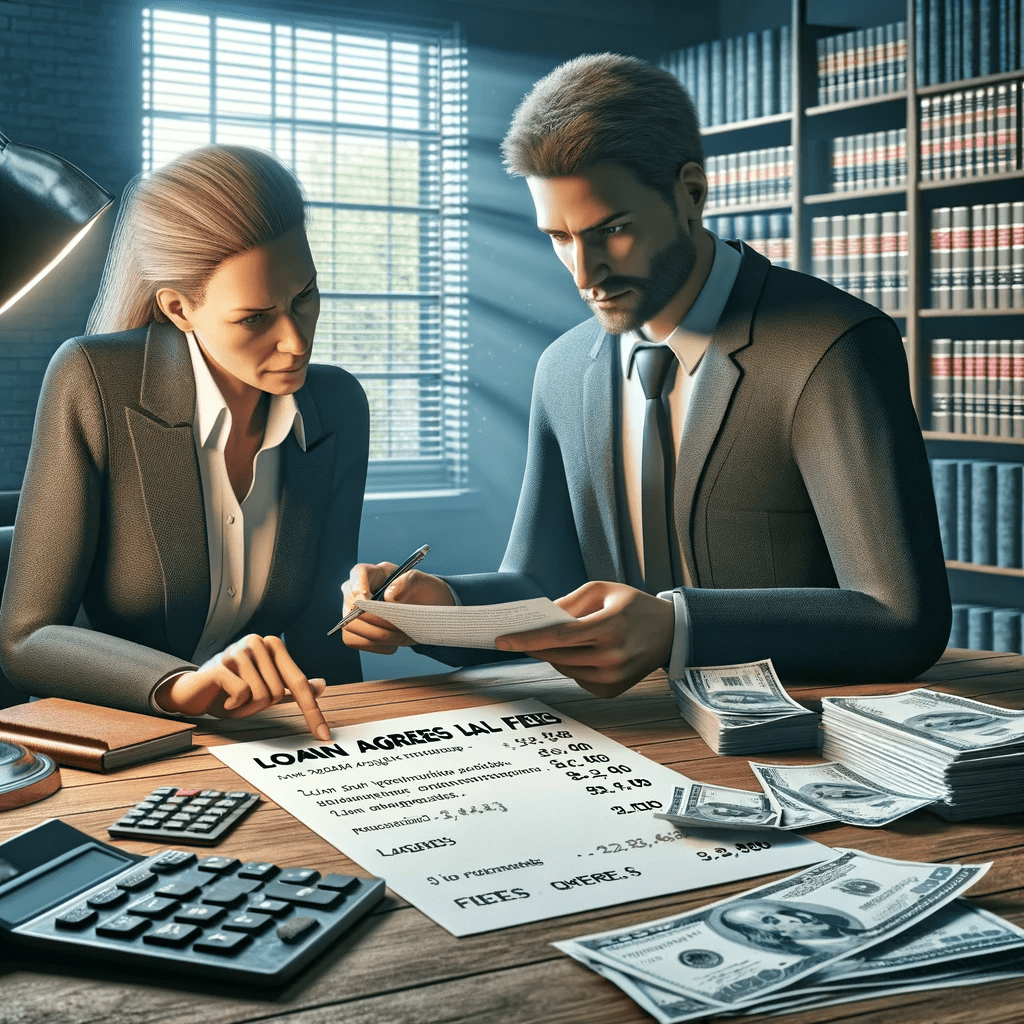

4. Legal Fees for Loan Agreement

Loan agreement legal fees are similar to SPA legal fees but are a separate cost. These are necessary for processing the mortgage.

5. Stamp Duty on Loan Agreement

This duty is charged at 0.5% of the loan amount.

6. Real Estate Agent’s Fee

The real estate agent’s fee is about 2-3% of the purchase price and is payable upon the successful transaction of the property.

7. Loan Processing Fee

Banks may charge a loan processing fee, though this can often be waived during promotional periods.

8. Property Valuation Fee

Before a mortgage is approved, banks require a valuation of the property. The cost varies based on property value and complexity.

9. Mortgage Insurance

Most loan agreements require Mortgage Reducing Term Assurance (MRTA) or Mortgage Level Term Assurance (MLTA), which cover the outstanding loan in the event of death or total permanent disability.

10. Additional Miscellaneous Costs

These can include various administrative fees, such as the cost for transferring the title and charges for conducting land searches.

Example Breakdown for a RM500,000 Property

- Down Payment: RM50,000

- SPA Legal Fees: RM5,000

- SPA Stamp Duty: RM9,000

- Loan Agreement Legal Fees: RM2,500

- Loan Agreement Stamp Duty: RM2,250

- Real Estate Agent’s Fee: RM15,000

- Loan Processing Fee: RM200

- Property Valuation Fee: RM2,000

- MRTA/MLTA: RM10,000

- Miscellaneous Fees: RM1,000

- Total Initial Transaction Costs: RM97,950

Ongoing Costs

1. Mortgage Repayments

The most substantial ongoing cost is the mortgage repayment, which varies based on the loan amount, interest rate, and tenure.

2. Property Assessment Tax

This is a local municipality tax based on the annual value of the property.

3. Quit Rent

Known as ‘cukai tanah,’ this is a small annual land tax charged by the state government.

4. Maintenance Fees

For properties in a development, such as condominiums, there will be maintenance or management fees to cover the upkeep of shared spaces and facilities.

5. Sinking Fund

A portion of the maintenance fee may be allocated to a sinking fund, used for significant repairs or upgrades to the property.

6. Insurance

Home insurance is essential to protect against unforeseen circumstances such as fire, natural disasters, or theft.

7. Renovation and Upkeep

Ongoing costs for general maintenance or renovations must be considered to maintain the property’s condition.

8. Utility Bills

Regular payments for electricity, water, internet, and sewage services.

Total Ongoing Costs for a RM500,000 Property (Yearly Estimate)

- Mortgage Repayments: RM24,000 (estimate)

- Property Assessment Tax: RM500

- Quit Rent: RM100

- Maintenance Fees: RM3,600 (RM300 per month)

- Sinking Fund: RM360 (10% of maintenance fees)

- Insurance: RM500

- Renovation and Upkeep: RM2,000

- Utility Bills: RM2,400

- Total Ongoing Costs (Yearly): RM33,460

In addition to these costs, homeowners may also incur fees for late payment charges or special assessments for major repairs not covered by the sinking fund.

Final Thoughts

Prospective homeowners in Malaysia must meticulously plan and prepare a comprehensive budget that encompasses both initial purchasing costs and ongoing expenses related to property ownership. It’s essential for buyers to thoroughly assess their current financial standing, including savings and income, while also considering future financial goals and potential risks. This financial foresight ensures the sustainability of the investment over the long term.

To navigate these financial waters effectively, potential buyers should actively seek professional financial advice tailored to their unique circumstances. Utilizing tools like mortgage and loan calculators will provide a clearer view of what to expect in terms of monthly repayments and overall financial commitment. Engaging with real estate professionals is also crucial, as they can offer valuable insights into the market, advice on hidden costs, and guidance on legal procedures.

By carefully calculating and anticipating these expenses, buyers can strategically manage their finances to accommodate both the upfront costs, such as down payments, legal fees, and transfer taxes, and the recurrent costs, including property taxes, maintenance fees, and insurance. Such thorough preparation paves the way for a successful and financially secure property ownership experience in Malaysia, ensuring that the property not only meets their current needs but also contributes positively to their long-term financial health.