Best Home Loan in Malaysia 2025 : Rates Compared

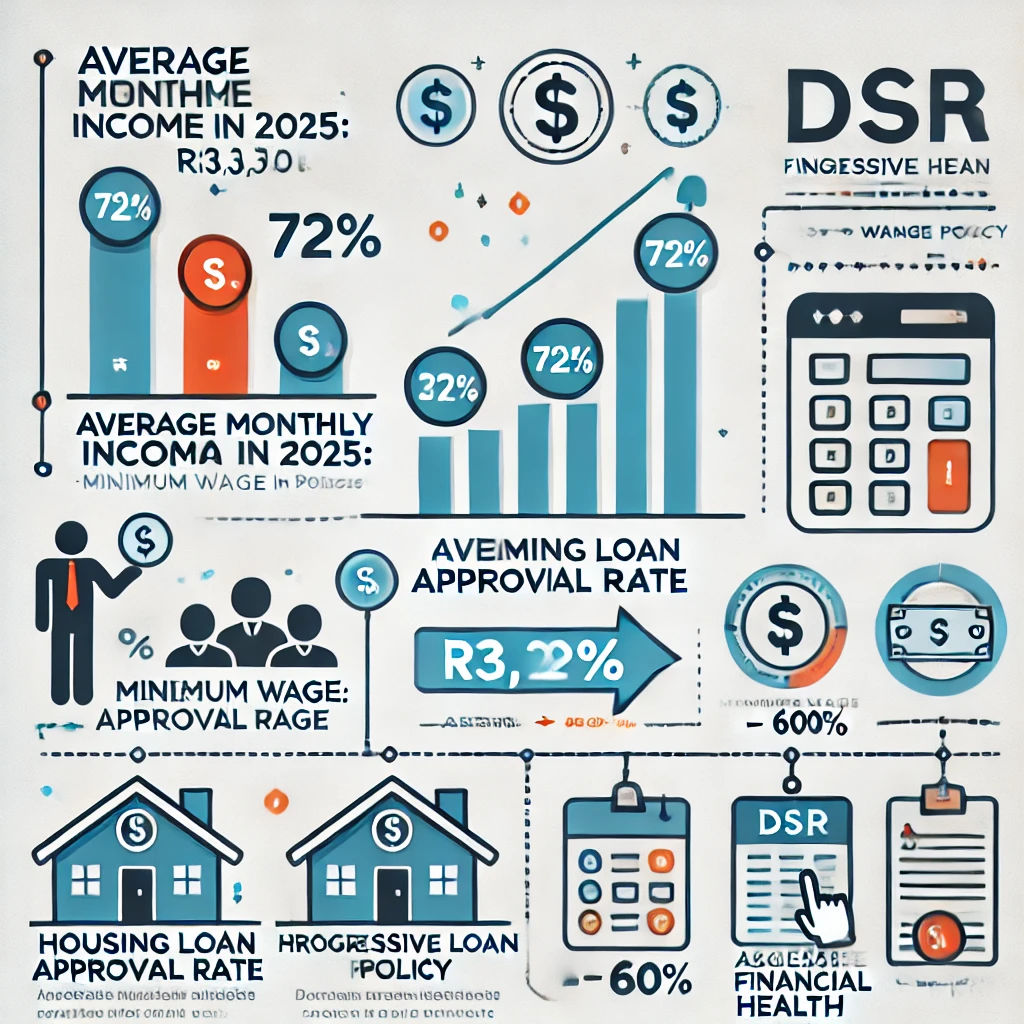

As of 2025, Malaysia’s average monthly income is projected to rise to RM3,971, driven by the implementation of a new minimum wage of RM1,700 and the Progressive Wage Policy (DGP), aimed at reducing income disparities and enhancing household purchasing power . Concurrently, the housing loan approval rate remains robust at approximately 72%, with a significant portion of approvals attributed to applicants maintaining a debt-service ratio below 60% . These developments underscore the importance for prospective homebuyers to assess their financial health, ensuring that their income levels and debt obligations align with lending criteria. By understanding these economic indicators, individuals can better position themselves to secure favourable home loan terms in Malaysia’s evolving financial landscape.

Bank Negara Malaysia kept the Overnight Policy Rate at 3.0 % on 8 May 2025, anchoring lending costs. Malay Mail Its latest Financial Stability Review shows housing-loan growth eased to 6.9 % y-o-y in 2024 (2023: 7.3 %), signalling balanced credit demand that is nudging lenders to sharpen rates. EdgeProp.my Meanwhile, the median debt-service ratio for newly approved mortgages held at a prudent 41 %, confirming that banks continue to apply strict affordability tests. Invest Malaysia Together, steady funding costs, moderated loan expansion and firm DSR limits suggest borrowers who keep their own DSR below 40 % and compare offers can still secure Malaysia’s best home-loan packages in 2025.

How to Secure the Best Home Loan in Malaysia: A 2025 Guide to Interest Rates and Strategies

Navigating the Home Loan Landscape in Malaysia

Securing a home loan is a significant step for many individuals looking to purchase property in Malaysia. Understanding the various components of a home loan, including the principal and interest, is essential for prospective buyers. This knowledge empowers individuals to make informed decisions that align with their financial goals.

The landscape of home loans in Malaysia is evolving, particularly as we approach 2025. With a variety of options available, it is crucial to compare rates and packages from different lenders before committing to a loan. This approach ensures that borrowers can find the most suitable financing options tailored to their needs.

As the market changes, staying updated on current interest rates and loan offerings becomes increasingly important. Engaging with resources that provide insights into the latest trends can help potential buyers navigate the complexities of securing a home loan. Understanding the implications of different loan types, such as fixed and variable rates, can significantly impact long-term financial planning.

For those considering purchasing property in prime locations, exploring the best luxury condo in KLCC or the best luxury condo in Kota Damansara can provide valuable insights into high-end market offerings. Similarly, understanding the options for the best condo in Shah Alamcan guide buyers towards making informed decisions in this vibrant area.

What is a Home Loan?

A home loan is a financial product designed to assist individuals in purchasing property, typically secured by the property itself. This type of loan allows borrowers to finance their home purchase over an extended period, usually ranging from 15 to 30 years.\n\nUnderstanding the structure of home loans is crucial for prospective buyers. The loan consists of two main components: the principal, which is the amount borrowed, and the interest, which is the cost of borrowing that amount. Borrowers should be aware of how these components interact, as they directly affect monthly repayments and the total cost of the loan over time.

In Malaysia, various types of home loans are available, catering to different needs and preferences. Retail mortgages are commonly offered by banks, while Islamic home financing provides Shariah-compliant options for those seeking alternatives to traditional loans. Government housing schemes also exist to support first-time buyers, making homeownership more accessible. Understanding these options can help individuals choose the right loan for their circumstances, ensuring a smoother home-buying experience.

When considering a home loan, it is essential to research current interest rates and compare offerings from multiple lenders. This process allows potential buyers to identify the most competitive rates available in the market. Additionally, understanding eligibility criteria and required documentation can streamline the application process, making it easier to secure financing.

Exploring special offers and incentives from banks can also lead to significant savings. Many lenders provide promotional packages that may include lower fees or cashback offers, particularly for first-time buyers. Assessing these options can enhance the overall affordability of a home loan, allowing borrowers to make more informed financial decisions.

Finally, reviewing the terms and conditions of a loan is vital. Borrowers should pay close attention to repayment durations, fees, and any prepayment penalties that may apply. This understanding can prevent unexpected costs and help individuals select a loan that aligns with their long-term financial goals.

By maintaining a strong credit score and considering the assistance of a mortgage broker, individuals can further enhance their chances of securing the best home loan available. Engaging with professionals in the field can provide valuable insights and streamline the application process, ultimately leading to a more successful home-buying experience.

How to Secure the Best Home Loan in Malaysia

Navigating the current landscape for home loans in Malaysia requires careful consideration and strategic planning. As of 2025, the competitive nature of the market presents an array of options, making it essential for potential homebuyers to evaluate and contrast loan products before making a commitment. Such diligence ensures that borrowers can capitalise on advantageous terms that are aligned with their financial circumstances.

Step 1: Research Current Interest Rates

Initiate the process by investigating the most recent home loan interest rates for 2025, as fluctuations occur frequently among different lenders. Access trustworthy online comparison platforms and financial news outlets to compile comprehensive information about varying rates, which will serve as a foundation for informed decision-making.

Step 2: Compare Mortgage Rates

Compile a detailed comparison chart of leading lenders showcasing their corresponding mortgage rates. Assess both variable and fixed-rate options; understanding how each type influences your repayment plan is crucial. Fixed rates provide stability, while variable rates may initially lower costs but come with the risk of fluctuations over time.

Step 3: Check Eligibility Criteria

Every financial institution establishes distinct eligibility criteria for their home loan offerings that potential borrowers must meet. Review the documentation required for the application process, including proof of income, creditworthiness, and other relevant financial information. Recognizing these requirements early expedites the application process and enhances the likelihood of approval.

Step 4: Explore Special Offers and Incentives

Take the time to investigate promotional deals provided by banks in 2025, as they often present significant opportunities for savings. Incentives tailored for first-time homebuyers, such as reduced fees or cashback offers, can positively influence your overall financial outlay. Identifying these promotions can make a considerable difference in the affordability of a home loan.\n\n

Step 5: Assess Loan Terms and Conditions

Thoroughly examine the terms of repayment associated with each loan option, focusing on the length of the loan, any applicable fees, and potential prepayment penalties. Gaining insight into these specifics allows you to avoid unforeseen costs and make more educated choices relative to your financial landscape.

Step 6: Finalise Your Application

Once you have compiled all requisite documentation and selected the most fitting loan package through rigorous analysis, prepare for submission of your application. Ensuring all paperwork is organized simplifies the process and supports efficient evaluation by the lender. Keeping communication lines open with the lender during the approval stage aids in addressing any questions or additional requirements effectively.

Navigating the home loan landscape can be complex, but with the right information and strategies, you can secure a financing option that fits your needs. Stay informed about the latest rates and offerings to make the best decisions for your future. If you need assistance, contact us to discover how our property solutions can grow your real estate business.