The post Top 10 Property Developers in Singapore 2024 appeared first on RealestateMY.

]]>In 2024, Singapore’s real estate landscape continues to be shaped by its innovative and reputable property developers. With a keen eye for both residential and commercial spaces, these developers are not just shaping the physical skyline but are also pivotal in setting new standards for sustainable and smart living in one of the world’s most dynamic urban environments. From iconic residential towers to sprawling retail hubs, these entities drive forward with ambitious projects that promise to enhance the livability and functionality of Singapore’s urban fabric, ensuring the city-state remains at the forefront of global real estate development.

Leading developers such as CapitaLand, City Developments Limited, and GuocoLand, among others, have each made significant contributions, continually pushing the boundaries of architectural excellence and innovative urban solutions. Here are some of the top property developers in Singapore for 2024, renowned for their high-quality developments and significant contributions to the real estate market:

City Developments Limited (CDL)

CDL is a major player with a strong international presence and a commitment to sustainability. Known for premium residential, commercial, and retail properties, they are recognized globally for their environmental-friendly practices.

City Developments Limited (CDL) had a significant year in 2023, marked by robust financial and operational achievements. The company posted a record revenue of S$4.9 billion, driven largely by its property development segment. This segment saw notable successes, including the full sale and completion of the Executive Condominium project Piermont Grand. Additionally, CDL made strategic acquisitions, such as St Katharine Docks in the UK and various properties in key overseas markets, contributing to a 31.8% growth in its investment properties segment.

Despite these achievements, CDL experienced a significant decrease in profit after tax and minority interests (PATMI), which was impacted by higher financing costs and the absence of large divestment gains seen in previous years. Nonetheless, the company’s residential sales remained resilient both in Singapore and overseas, with strong sales from project launches such as Tembusu Grand and The Myst.

CDL also focused on sustainability, maintaining its high ranking in the Global 100 Most Sustainable Corporations and continuing to invest in green and sustainable projects. This aligns with their long-standing commitment to environmental stewardship and corporate responsibility.

CapitaLand

As one of Asia’s largest real estate companies, CapitaLand is noted for its innovative and high-end projects like Jewel Changi Airport and ION Orchard. They are known for their unique designs and luxury offerings.

CapitaLand Investment (CLI) had a productive year in 2023, marked by strategic achievements and strong financial performance, despite facing some macroeconomic headwinds. The company posted a resilient financial outcome with a cash PATMI (Profit After Tax and Minority Interests) of S$781 million for the full year. This result was supported by a robust fee income-related business, which saw significant growth due to increased fund management fees and higher earnings from lodging management.

One of the standout achievements for CapitaLand in 2023 was its commitment to sustainability, which continued to be a core focus. The company and its listed trusts achieved top ratings in the 2023 GRESB Real Estate Assessment, reflecting its dedication to environmental, social, and governance (ESG) goals. This recognition has also enabled CapitaLand to secure substantial sustainable financing, which is tied to their performance on these ESG metrics.

In addition to financial performance, CapitaLand has been actively managing its portfolio through asset recycling and diversification, raising S$2.8 billion in third-party capital to strengthen its global reach and expand its fund management activities. The company remains focused on growing its asset-light fee-related earnings and expanding its network of global institutional investors and capital partners.

Moreover, CapitaLand is planning to double its funds under management (FUM) to S$200 billion by the end of 2028, highlighting an ambitious growth trajectory that includes expanding its fund management in emerging markets like India and Southeast Asia, as well as optimising its portfolio in China.

Overall, CapitaLand has demonstrated resilience and strategic foresight in navigating a challenging environment, laying a solid foundation for future growth and sustainability initiatives.

Far East Organization

The largest private property developer in Singapore, Far East Organisation has an extensive portfolio across various sectors including residential, hospitality, and retail. They are especially celebrated for their high-quality standards and have received multiple international accolades for their work.

Over the past year, Far East Organisation, Singapore’s largest private property developer, has continued to make significant strides in the real estate and retail sectors. The organisation clinched two prestigious awards at the Retail Asia Awards 2023, highlighting its innovative contributions to the industry. These awards include the Retail App of the Year for its shopFarEast App and the ESG Initiative of the Year for Baker X @ Orchard Central, an initiative supporting home bakers by providing them retail space to test and grow their businesses.

Additionally, Far East Organisation’s commitment to innovation and quality is evident in its ongoing projects and the accolades it has received for its developments. The company is known for its diverse portfolio that includes residential, hospitality, and commercial properties. This diversified approach not only strengthens its market presence but also contributes to its reputation for excellence in property development.

Furthermore, the organisation’s dedication to sustainability and community engagement continues to be a core focus, reinforcing its mission to inspire better lives through high-quality real estate developments and community-centric initiatives.

MCL Land

A subsidiary of the Jardine Matheson Group, MCL Land has a long history of residential development in Singapore. They are known for their competitive land bidding and diverse range of properties that cater to different budgets and preferences.

Over the past year, MCL Land, a subsidiary of Hongkong Land, has continued to make significant strides in Singapore’s residential property market. One of the major highlights for MCL Land in 2023 was the launch of Tembusu Grand in Katong, a joint venture with City Developments Limited (CDL). This development quickly captured market attention, selling 53% of its units shortly after launch at an average price of $2,465 per square foot, which speaks to the strong market demand for well-designed residences in prime locations.

MCL Land’s Tembusu Grand is especially notable because it was the first major residential launch in its district for nearly two decades, indicating a pent-up demand in the area. The project includes features tailored to modern living, such as unblocked panoramic views for units on higher floors and a range of amenities that cater to both families and individuals.

Additionally, MCL Land has been actively participating in government land sales (GLS), submitting competitive bids for several sites, which demonstrates their ongoing commitment to expanding their development portfolio in Singapore. This activity reflects a strategic approach to securing prime land, ensuring the company’s continued growth in the residential sector.

MCL Land’s achievements in the past year highlight their dedication to innovation, quality, and sustainability in developing residential properties that offer long-term value to homeowners and investors alike.

GuocoLand

With operations extending beyond Singapore to regions like Malaysia, China, Vietnam, and more, GuocoLand has been recognised for luxury projects such as the Wallich Residence. They focus on quality and innovation in their developments.

Over the past year, GuocoLand has made significant strides in Singapore, notably with the development of Guoco Midtown. This project is set to redefine urban living with its blend of residential, commercial, and public spaces, emphasising sustainability and community connectivity. Highlighting its commitment to innovation, GuocoLand was also recognised at the SBR Technology Excellence Awards 2023 for advancements in property technology, further establishing its reputation as a leader in the real estate sector.

Frasers Property

Operating globally, Frasers Property offers a wide range of residential and commercial developments. They are known for their commitment to quality and have received numerous awards for their projects.

Over the past year, Frasers Property Singapore has made significant strides in the real estate sector with notable accomplishments in sustainability, strategic acquisitions, and enhancing community spaces. They completed major investment moves such as acquiring a 50% stake in NEX and increasing their stake in Waterway Point, making them the largest suburban retail mall owner in Singapore. They also undertook a $40 million asset enhancement initiative for Alexandra Point, transforming it into a workspace of the future with sustainable and digital innovations.

Additionally, Frasers Property has been acknowledged for its commitment to environmental sustainability, securing top ratings from the Global Real Estate Sustainability Benchmark (GRESB). They have also focused on innovative green financing solutions, aligning their operations with broader environmental goals.

These efforts reflect Frasers Property Singapore’s commitment to innovation, sustainability, and providing value to the communities they serve, continually enhancing their portfolio across residential, commercial, and retail domains.

Allgreen Properties

A part of the Kuok Group, Allgreen is one of the largest property developers in Singapore, known for their luxury condos and strong portfolio of residential projects.

In the past year, Allgreen Properties has made significant advancements in Singapore’s real estate market. One of their notable achievements includes the acquisition of The Seletar Mall for S$550 million. This purchase is part of Allgreen’s strategic initiative to enhance its retail portfolio and expand its presence in Singapore’s suburban retail sector, which continues to show resilience and growth potential.

Additionally, Allgreen Properties was recognised at the SBR Technology Excellence Awards 2023, where they won in the Information Management – Real Estate category. This award highlights their successful efforts in digital transformation aimed at improving operational efficiency through advanced technology solutions.

Wrapping up

As we review the achievements and innovations of Singapore’s leading property developers in 2024, it is evident that their commitment to excellence and sustainability continues to drive the nation’s real estate market forward. These developers have not only succeeded in creating functional and visually stunning spaces but have also prioritised green initiatives and technological advancements that set new industry standards. Their efforts ensure that Singapore remains a top destination for investors and a model of urban development worldwide.

The landscape of Singapore real estate, enriched by these developers’ contributions, promises exciting possibilities for future projects and developments. These developers are highlighted for their reliable market presence, consistent quality, and innovative approaches to property development in Singapore. For anyone considering an investment or purchase, these developers represent some of the best options in the market today.

The post Top 10 Property Developers in Singapore 2024 appeared first on RealestateMY.

]]>The post How to find a real estate agency in Malaysia appeared first on RealestateMY.

]]>As a prospective homebuyer or seller in Malaysia, you may be considering working with a real estate agency to help you navigate the complex process of buying or selling a property. Real estate agencies can provide valuable assistance with tasks such as finding a suitable property, negotiating the terms of a sale or purchase, and handling the paperwork involved in a real estate transaction.

However, with so many agencies to choose from, how do you know which one is right for you? Here are some tips for finding a real estate agency in Malaysia:

Determine your needs

Before you start searching for a real estate agency, it’s crucial to clearly define your objectives and expectations regarding your property transaction. Are you looking to buy a new home, or are you interested in selling your current property? Establishing a specific budget and understanding your financial limits will also guide your decisions and help the agency tailor its services to your needs. Additionally, consider any particular preferences you have, such as a desired location, type of property, or specific amenities.

Having a well-defined list of requirements will enable you to find an agency that can effectively meet your needs and provide targeted, efficient assistance. This preparatory step is key to ensuring that the agency you choose can align its efforts with your goals, making the property buying or selling process as smooth and successful as possible.

Research the agency’s credentials

Look for an agency with experience in your area

Consider the agency’s specialisation

When choosing a real estate agency, it’s beneficial to consider agencies that may specialise in specific types of properties or market sectors, such as residential, commercial, or rural. Working with an agency that has specialised knowledge in the area you are interested in can greatly enhance your experience. Such specialisation often means that the agency possesses a deeper understanding of the market dynamics, legal considerations, and potential opportunities specific to that segment. For example, an agency focusing on commercial properties will be adept at navigating business-related real estate transactions, while one specialising in residential properties might be better at understanding home valuations and neighbourhood qualities. Deciding to partner with an agency that aligns with your specific property interests can lead to more tailored advice and a more efficient property buying or selling process.

Ask for recommendations

If you are in the process of buying or selling a property in Malaysia, tapping into your network for recommendations can be highly beneficial. Individuals who have recently navigated the real estate market can provide firsthand insights and suggest agencies they found competent and trustworthy. In addition to personal acquaintances, consulting other real estate professionals such as valuers or appraisers is a smart move.

These experts frequently interact with various agencies and can offer valuable recommendations based on their professional experiences and observations of agencies’ performance and ethics. Gathering this type of feedback can help you compile a list of reputable agencies, making it easier to choose one that best suits your needs and enhances your chances of a successful transaction.

Check the agency’s online presence

Many real estate agencies in Malaysia leverage an online presence, utilising platforms like personal websites or social media to showcase their services. Browsing these digital footprints can be an effective way to gain insights into an agency’s professionalism and approach to marketing properties.

Their online content often reflects their market positioning, the types of properties they handle, and their customer interaction style. Additionally, social media interactions and online reviews can provide a glimpse into their reputation and effectiveness in engaging with clients, helping you assess if their approach aligns with your needs.

Meet with the agency in person

It is highly beneficial to arrange meetings with several real estate agencies to personally assess their personality and working style. Such face-to-face interactions allow you to ask detailed questions and evaluate how well you connect with the agency’s representatives.

This personal engagement can reveal a lot about their communication skills, understanding of your needs, and overall customer service approach. Feeling comfortable and confident with your chosen agency is crucial, as this relationship will be central to navigating the complexities of real estate transactions effectively.

Consider the agency’s fees

Look for good communication skills

By following these tips, you can find a real estate agency in Malaysia that is well-suited to your needs and can help you navigate the complex process of buying or selling a property with confidence.

Conclusion

The post How to find a real estate agency in Malaysia appeared first on RealestateMY.

]]>The post How to choose a property developer in Malaysia appeared first on RealestateMY.

]]>Choose the right property developer in Malaysia

Picking the right property developer is crucial for ensuring the success of your property investment in Malaysia. A good developer not only impacts the quality and delivery of your property but also affects its long-term value. When choosing a property developer in Malaysia, it’s important to consider their reputation, experience, and financial stability. Here are some practical tips to guide you through the process of selecting a reliable property developer in Malaysia:

Check the property developer’s track record

It’s important to research the developer’s past projects to get an idea of their capabilities and level of professionalism. Examining their completed projects, especially those similar to what you’re considering, can provide valuable insights into their consistency and quality of work. Look at the structural integrity, design aesthetics, and community reviews of these projects.

Additionally, online reviews and customer testimonials are indispensable resources that reflect the developer’s reputation. Asking for references and speaking directly with previous clients can further verify the developer’s reliability and your potential satisfaction. This thorough approach will help you make a well-informed decision about investing with a particular property developer.

Consider the location

Location is a key factor to consider when choosing a property developer in Malaysia. Opting for developers with a solid track record of successful projects in your desired area can significantly boost your confidence in their expertise and understanding of the local market dynamics. Such developers are likely to have established relationships with local authorities and suppliers, which can facilitate smoother project execution.

Furthermore, their familiarity with the local demographics and market trends ensures that they can deliver a product that meets the expectations of potential buyers or tenants. By prioritizing developers who specialize in specific regions, you are more likely to invest in a property that not only aligns with market demands but also maintains its value over time.

Look for transparency

A good developer will be upfront about their processes and pricing, providing a transparent and detailed breakdown of costs, including any additional fees that may be incurred throughout the development process. It is crucial to work with a developer who communicates clearly and openly, ensuring that you are fully informed about every aspect of your investment.

Avoid developers who are vague or evasive when answering your questions, as this can be a red flag indicating potential hidden costs or issues down the line. A trustworthy developer will ensure that all financial aspects are discussed upfront, eliminating surprises and building a foundation of trust. Such transparency not only helps in making an informed decision but also fosters a reliable and professional relationship.

Verify the developer’s credentials

Ensuring that your property developer is registered with the relevant authorities and possesses the necessary licenses to operate is fundamental in providing you with the confidence that they are compliant with legal requirements and industry standards. Registration and licensing serve as crucial indicators of a developer’s credibility and professionalism.

This compliance guarantees that they are not only legally authorised to undertake property development projects but are also likely to adhere to safety, quality, and environmental standards set by regulatory bodies. By verifying these credentials, you can protect your investment and avoid potential legal or financial complications associated with unlicensed developers. This vigilance is essential for maintaining peace of mind and ensuring a successful property development experience.

Review the contract carefully

Before committing to a contract with a property developer, it is imperative that you fully understand all the terms and conditions laid out within the document. Pay particular attention to clauses that define both the developer’s responsibilities and your obligations as the buyer or investor. This includes stipulations on project timelines, payment schedules, and quality standards.

To ensure that your interests are adequately protected, it is advisable to have the contract reviewed by a legal expert. A lawyer specialised in real estate can offer invaluable advice, highlight any potentially unfair terms, and help negotiate modifications if necessary. This careful scrutiny helps safeguard your investment and avoid future disputes, ensuring that all parties are clear on their commitments.

Consider the developer’s reputation

When choosing a property developer, it is essential to consider their reputation within the industry, as this is a strong indicator of their reliability and the quality of their work. A developer’s reputation can often be assessed through online reviews, industry awards, and word-of-mouth referrals. Positive feedback and accolades are signs of a developer’s commitment to excellence and customer satisfaction.

Furthermore, a developer that enjoys a good standing among peers and customers is more likely to deliver on their promises, adhere to timelines, and maintain high standards of customer service. These factors combined ensure a smoother and more satisfactory property development process. Thus, prioritising a well-regarded developer can significantly enhance your overall investment experience.

Don’t be afraid to negotiate

It’s important to remember that as the customer, you hold significant negotiating power when dealing with property developers. You should not hesitate to leverage this position to your advantage. Whether it’s negotiating for price reductions, requesting additional features, or asking for upgraded amenities, you have the right to make these demands.

Developers are often willing to accommodate reasonable requests to secure a sale, especially in competitive markets. Engaging in negotiation not only potentially lowers your costs but can also enhance the value of your property investment. Always approach these discussions with confidence and clarity about what you want to achieve, ensuring you communicate your needs effectively to the developer. This proactive approach can make a substantial difference in the final outcome of your property purchase.

Consider the developer’s financial stability

Choosing a financially stable property developer is crucial to ensuring that your project will be completed and that all promises made will be kept. A developer with a solid financial foundation is less likely to face insolvency issues, which can lead to project delays or halts. To assess a developer’s financial health, it’s wise to review their financial statements, which can provide insight into their liquidity, debt levels, and overall financial performance.

Additionally, requesting references from banks or other financial institutions with whom they have had dealings can offer further evidence of their financial reliability. These steps are essential to gain confidence in the developer’s ability to manage and complete your project efficiently, safeguarding your investment in the process.

Consider the developer’s customer service

Customer service is a critical factor when selecting a property developer in Malaysia. A responsive and attentive developer can significantly enhance your experience by ensuring that all your inquiries and concerns are addressed promptly and efficiently. When choosing a developer, look for one who is known for their proactive customer support—someone who not only answers your questions but also anticipates potential issues and offers solutions.

A developer willing to go the extra mile demonstrates a commitment to customer satisfaction and reliability. This commitment can manifest in various ways, such as providing regular updates on project progress, being available for meetings, and offering after-sales support. Opt for a developer who prioritizes communication and service, as this can make all the difference in managing the complexities of property development and ensuring a positive outcome.

By following these tips, you can feel confident that you are choosing a property developer in Malaysia who is capable of delivering a high-quality product and providing excellent customer service.

Conclusion

In conclusion, choosing the right property developer in Malaysia is pivotal for the success of your investment. It requires thorough research and careful consideration of several key factors, including the developer’s reputation, financial stability, and commitment to customer service. Assessing their past projects, responsiveness, and willingness to engage transparently with clients are also critical.

By ensuring that the developer you select not only meets these criteria but also aligns with your specific needs and expectations, you can significantly enhance the likelihood of a satisfactory and rewarding property development experience. Remember, a well-chosen developer is not just a service provider, but a partner in achieving your real estate goals.

The post How to choose a property developer in Malaysia appeared first on RealestateMY.

]]>The post How to find a property agent in Malaysia appeared first on RealestateMY.

]]>As a prospective homebuyer or seller in Malaysia, you may be considering working with a property agent to help you navigate the real estate market. Property agents, also known as real estate agents, can provide valuable assistance with tasks such as finding a suitable property, negotiating the terms of a sale or purchase, and handling the paperwork involved in a real estate transaction. However, with so many agents to choose from, how do you know which one is right for you?

Here are some tips for finding a property agent in Malaysia:

Determine your needs.

Before you start searching for an agent, it’s important to have a clear idea of what you are looking for in a property and what you expect from an agent. Are you looking to buy or sell a home? Do you have a specific budget in mind? Do you have any particular requirements, such as a certain location or type of property? Knowing your needs will help you find an agent who can effectively meet them.

Research the agent’s credentials

In Malaysia, property agents must be licensed by the Board of Valuers, Appraisers, Estate Agents, and Property Managers (BOVAEP). You can check the agent’s credentials by searching the BOVAEP database or by asking to see their license. It’s also a good idea to check for any complaints or disciplinary action against the agent.

Look for an agent with experience in your area.

It’s important to find an agent who is familiar with the local real estate market and has experience in the area where you are looking to buy or sell. An agent with local knowledge can provide valuable insights and help you make informed decisions.

Consider the agent’s specialisation

Some property agents may specialize in certain types of properties or markets, such as residential, commercial, or rural. Consider whether you would like to work with an agent who has specialized knowledge in a particular area.

Ask for recommendations

If you know anyone who has recently bought or sold a property in Malaysia, they may be able to recommend a good agent. You can also ask for recommendations from other real estate professionals, such as valuers or appraisers.

Check the agent’s online presence

Many property agents in Malaysia have an online presence, whether through a personal website or social media. This can be a good way to learn more about the agent and get a sense of their approach to marketing properties.

Meet with the agent in person

It’s a good idea to meet with a few different agents in person to get a feel for their personality and style. This will give you a chance to ask questions and see if you feel comfortable working with them.

Consider the agent’s fees

Property agents in Malaysia generally charge a commission based on the sale price of the property. This commission is typically split between the seller’s agent and the buyer’s agent. Be sure to ask about the agent’s fees and how they are calculated.

Look for good communication skills

Good communication is key in any successful real estate transaction. Look for an agent who is responsive, reliable, and able to clearly explain the process and answer your questions.

By following these tips, you can find a property agent in Malaysia who is well-suited to your needs and can help you navigate the real estate market with confidence.

Conclusion

In conclusion, finding the right property agent in Malaysia is a critical step that can greatly influence the success of your real estate endeavours, whether you’re buying or selling. A competent agent will not only simplify the complexities of property transactions but also ensure that you get the best possible deal. To choose the most suitable agent, focus on their market knowledge, experience, client reviews, and professional credentials.

Utilise referrals from trusted sources and thoroughly research potential agents through online reviews and real estate platforms. Prioritise communication and a shared understanding of your goals during initial consultations. By carefully selecting a property agent who aligns with your needs and demonstrates a commitment to your interests, you can navigate the Malaysian real estate market with confidence and ease, ensuring a smoother and more rewarding property transaction.

The post How to find a property agent in Malaysia appeared first on RealestateMY.

]]>The post How to rent to own in Malaysia appeared first on RealestateMY.

]]>Rent To Own in Malaysia

Rent-to-own (RTO) is a distinctive property arrangement in Malaysia designed for individuals who aspire to homeownership but may not immediately qualify for a mortgage or possess the necessary down payment. In an RTO agreement, tenants rent a property for a set period, during which a portion of their monthly rent payments accumulates as credit towards the eventual purchase price. At the end of the rental term, they have the option to buy the property.

This article explores the specifics of how to engage in a rent-to-own agreement in Malaysia, detailing the process, eligibility criteria, and both the financial and practical benefits and drawbacks. Understanding these factors is crucial for potential buyers considering this path to homeownership, as it allows them to strategically plan their finances while gradually building equity in the home.

Understand the process

In a rent-to-own arrangement in Malaysia, the tenant pays a monthly rent that includes a portion that goes towards the eventual purchase of the property. The tenant also has the option to buy the property at any time during the rental period, typically at a pre-agreed upon price.

To enter into a rent-to-own arrangement, the tenant and property owner will typically sign a rental agreement that includes the terms of the RTO option. This agreement should specify the purchase price, the length of the rental period, the amount of the monthly rent and the portion that goes towards the purchase, and any other terms or conditions of the RTO option.

Meet the eligibility requirements

Consider the benefits and drawbacks

Rent-to-own can be a useful option for individuals who are not yet able to qualify for a mortgage or who want to build up their credit and savings before purchasing a property. It can also allow the tenant to try out a property and a neighborhood before committing to a purchase.

However, there are also potential drawbacks to rent-to-own in Malaysia. The tenant may end up paying more for the property over time due to the added cost of the rent-to-own option, and there is no guarantee that the tenant will be able to purchase the property at the end of the rental period. Additionally, the tenant may be responsible for maintaining and repairing the property during the rental period, and may not have the same legal protections as a traditional homeowner.

Seek legal advice

When considering a rent-to-own agreement in Malaysia, it is crucial to have a comprehensive understanding of all the terms and conditions involved. To safeguard your interests, seeking legal advice is highly recommended. A qualified lawyer will not only help you grasp your rights and obligations under the agreement but will also ensure that the terms are fair and legally enforceable.

This step is essential to prevent any potential legal complications and to confirm that the agreement aligns with your financial capabilities and homeownership goals. Engaging a lawyer early in the process helps ensure that all aspects of the contract are transparent and beneficial for both parties involved.

Explore other options

If you’re looking to buy property in Malaysia but aren’t currently in a position to qualify for a traditional mortgage, there are alternative paths you can explore. One viable option is a lease-purchase agreement, which allows you to lease a property while retaining the option to buy it at a later stage, often under pre-agreed terms.

Additionally, consider enhancing your eligibility for a mortgage by improving your credit score, accumulating a more substantial down payment, or possibly leveraging the financial strength of a co-borrower. These strategies can significantly increase your chances of securing a mortgage, making your goal of owning a home more attainable.

Conclusion

In conclusion, the rent-to-own (RTO) scheme presents a practical alternative for individuals aspiring to own a property in Malaysia but who may not yet qualify for a conventional mortgage. This option bridges the gap between renting and owning, allowing potential homeowners to build equity through their rental payments, which are partially credited towards the purchase price of the property.

However, entering into an RTO agreement requires a thorough understanding of its terms to ensure that it aligns with your financial goals and capabilities. It is crucial to meet all eligibility requirements and to weigh the potential benefits against the possible drawbacks. Given the significant legal and financial implications, seeking professional legal advice is highly recommended to navigate this process effectively.

Additionally, exploring other financing options, such as securing a mortgage with the help of a co-borrower, improving your credit score, or saving for a more substantial down payment, can provide alternative routes to property ownership. Each of these steps will help ensure that you make an informed decision that best suits your long-term housing and financial needs.

The post How to rent to own in Malaysia appeared first on RealestateMY.

]]>The post The total cost for buying a home in Malaysia appeared first on RealestateMY.

]]>Buying a home in Malaysia is a substantial financial undertaking, and it requires a comprehensive understanding of all associated costs to effectively budget for this major investment. In Malaysia, the total costs involved in purchasing a home extend beyond the simple price of the property. Initial expenses typically include the down payment, legal fees, stamp duties, and possibly agent fees. Additionally, there are ongoing costs to consider such as property taxes, maintenance fees, and insurance.

Understanding these fees in detail is crucial for prospective homeowners to ensure financial readiness. This breakdown helps in planning not only for the upfront costs but also for the long-term financial commitment involved in owning a property in Malaysia. By anticipating these expenses, buyers can manage their finances more effectively, avoiding unexpected burdens as they navigate the complexities of the property market.

Let’s break down the total costs involved in purchasing a home in Malaysia, covering both initial and ongoing expenses.

Initial Transaction Costs

1. Down Payment

The initial financial commitment when purchasing a home is the down payment, typically 10% of the property’s price. This is the part of the cost that cannot be financed through a loan.

2. Sale and Purchase Agreement (SPA) Costs

Legal fees for drafting the SPA are calculated as a percentage of the property price. This usually starts at 1% for the first RM500,000 and gradually decreases to 0.5% as the property value increases.

3. Stamp Duty on SPA

The Malaysian government levies a stamp duty on property transactions, tiered as follows:

- 1% on the first RM100,000

- 2% on the subsequent RM400,000

- 3% on the subsequent value

Starting in 2019, for first-time homebuyers, there is a stamp duty exemption on the first RM300,000 on homes priced from RM300,001 to RM1 million.

4. Legal Fees for Loan Agreement

Loan agreement legal fees are similar to SPA legal fees but are a separate cost. These are necessary for processing the mortgage.

5. Stamp Duty on Loan Agreement

This duty is charged at 0.5% of the loan amount.

6. Real Estate Agent’s Fee

The real estate agent’s fee is about 2-3% of the purchase price and is payable upon the successful transaction of the property.

7. Loan Processing Fee

Banks may charge a loan processing fee, though this can often be waived during promotional periods.

8. Property Valuation Fee

Before a mortgage is approved, banks require a valuation of the property. The cost varies based on property value and complexity.

9. Mortgage Insurance

Most loan agreements require Mortgage Reducing Term Assurance (MRTA) or Mortgage Level Term Assurance (MLTA), which cover the outstanding loan in the event of death or total permanent disability.

10. Additional Miscellaneous Costs

These can include various administrative fees, such as the cost for transferring the title and charges for conducting land searches.

Example Breakdown for a RM500,000 Property

- Down Payment: RM50,000

- SPA Legal Fees: RM5,000

- SPA Stamp Duty: RM9,000

- Loan Agreement Legal Fees: RM2,500

- Loan Agreement Stamp Duty: RM2,250

- Real Estate Agent’s Fee: RM15,000

- Loan Processing Fee: RM200

- Property Valuation Fee: RM2,000

- MRTA/MLTA: RM10,000

- Miscellaneous Fees: RM1,000

- Total Initial Transaction Costs: RM97,950

Ongoing Costs

1. Mortgage Repayments

The most substantial ongoing cost is the mortgage repayment, which varies based on the loan amount, interest rate, and tenure.

2. Property Assessment Tax

This is a local municipality tax based on the annual value of the property.

3. Quit Rent

Known as ‘cukai tanah,’ this is a small annual land tax charged by the state government.

4. Maintenance Fees

For properties in a development, such as condominiums, there will be maintenance or management fees to cover the upkeep of shared spaces and facilities.

5. Sinking Fund

A portion of the maintenance fee may be allocated to a sinking fund, used for significant repairs or upgrades to the property.

6. Insurance

Home insurance is essential to protect against unforeseen circumstances such as fire, natural disasters, or theft.

7. Renovation and Upkeep

Ongoing costs for general maintenance or renovations must be considered to maintain the property’s condition.

8. Utility Bills

Regular payments for electricity, water, internet, and sewage services.

Total Ongoing Costs for a RM500,000 Property (Yearly Estimate)

- Mortgage Repayments: RM24,000 (estimate)

- Property Assessment Tax: RM500

- Quit Rent: RM100

- Maintenance Fees: RM3,600 (RM300 per month)

- Sinking Fund: RM360 (10% of maintenance fees)

- Insurance: RM500

- Renovation and Upkeep: RM2,000

- Utility Bills: RM2,400

- Total Ongoing Costs (Yearly): RM33,460

In addition to these costs, homeowners may also incur fees for late payment charges or special assessments for major repairs not covered by the sinking fund.

Final Thoughts

Prospective homeowners in Malaysia must meticulously plan and prepare a comprehensive budget that encompasses both initial purchasing costs and ongoing expenses related to property ownership. It’s essential for buyers to thoroughly assess their current financial standing, including savings and income, while also considering future financial goals and potential risks. This financial foresight ensures the sustainability of the investment over the long term.

To navigate these financial waters effectively, potential buyers should actively seek professional financial advice tailored to their unique circumstances. Utilizing tools like mortgage and loan calculators will provide a clearer view of what to expect in terms of monthly repayments and overall financial commitment. Engaging with real estate professionals is also crucial, as they can offer valuable insights into the market, advice on hidden costs, and guidance on legal procedures.

By carefully calculating and anticipating these expenses, buyers can strategically manage their finances to accommodate both the upfront costs, such as down payments, legal fees, and transfer taxes, and the recurrent costs, including property taxes, maintenance fees, and insurance. Such thorough preparation paves the way for a successful and financially secure property ownership experience in Malaysia, ensuring that the property not only meets their current needs but also contributes positively to their long-term financial health.

The post The total cost for buying a home in Malaysia appeared first on RealestateMY.

]]>The post Can expats get mortgages in Malaysia appeared first on RealestateMY.

]]>Purchasing property in Malaysia is highly appealing to many foreigners, attracted by the nation’s vibrant culture, strategic geographic position in Southeast Asia, and real estate prices that are notably more affordable compared to those in neighbouring countries like Singapore and Hong Kong. These factors make Malaysia a desirable destination for both living and investing.

However, non-citizens face unique challenges when trying to acquire property, primarily due to stringent regulations surrounding financing. Foreign buyers encounter more restrictive conditions, such as higher minimum purchase prices and lower loan-to-value (LTV) ratios. This article provides an in-depth exploration of the possibilities and procedures for foreigners to secure home loans in Malaysia, detailing the financial landscape and offering crucial insights into navigating these complex requirements.

Eligibility for Foreigners to Buy Property in Malaysia

Before diving into the specifics of home loans, it’s important to understand the property buying landscape in Malaysia. Malaysia generally welcomes foreign investment in its real estate sector, but there are restrictions aimed at controlling the types of properties foreigners can buy and their minimum value.

Typically, each state in Malaysia has a different minimum purchase value for foreigners, which usually starts from RM1 million (about $240,000). This threshold is part of the government’s effort to ensure that the premium segments of the market are targeted by foreign investors.

Obtaining a Home Loan as a Foreigner

Securing a mortgage as a foreigner in Malaysia is achievable, but it entails more stringent conditions than those facing local buyers. Foreigners often encounter lower loan-to-value ratios and must meet higher minimum property value thresholds. Key considerations include navigating extensive documentation requirements, potentially higher interest rates, and rigorous financial scrutiny. It’s essential for foreign buyers to be well-prepared for these challenges to successfully finance their property purchases in Malaysia.

Here are some key points to consider:

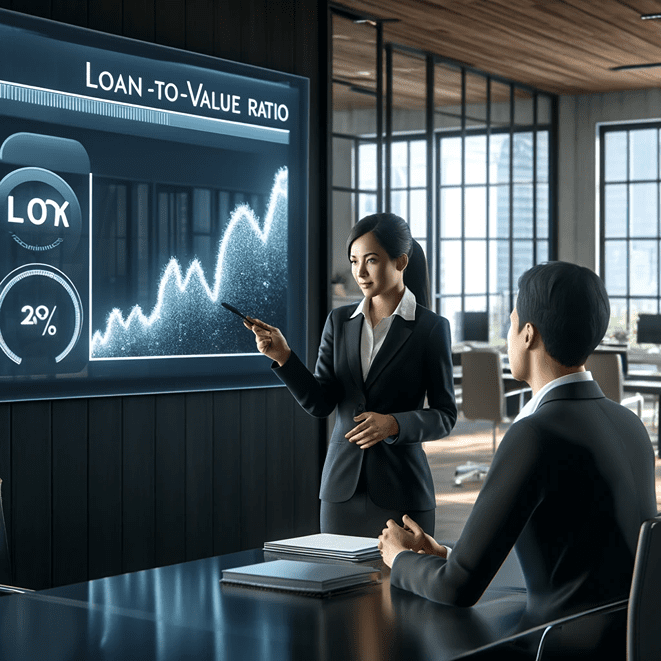

Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio offered to foreigners buying property in Malaysia is typically less generous than that available to local buyers. Malaysian citizens can often secure financing covering up to 90% of their property’s value. In contrast, foreigners generally face a cap of about 70%.

This significant difference requires foreign purchasers to come prepared with a larger initial down payment, impacting their overall budgeting and investment strategy. Understanding these financing constraints is crucial for foreigners aiming to navigate the Malaysian real estate market effectively, ensuring they are financially prepared for the additional upfront costs involved.

Type of Property

In Malaysia, the options available for property purchases by foreigners are specifically regulated to include only residential properties. This category encompasses apartments, condominiums, and individual houses. However, foreign buyers are restricted from acquiring land, properties designated as Bumiputera-reserved (a status reserved for the native Malay population), and any properties that fall below a certain price threshold set by individual states.

This minimum price cap is implemented to maintain higher-end residential markets primarily for foreign investment, ensuring that more affordable local housing remains accessible for Malaysian citizens. These regulations are crucial for foreigners to understand before embarking on property investment in Malaysia.

Financial Background Checks

Banks in Malaysia implement rigorous procedures to assess the financial backgrounds of potential borrowers, especially when it involves foreign buyers. This thorough vetting process includes an in-depth examination of your credit score, income levels, existing debt obligations, and current employment status.

Due to the perceived higher risk associated with foreign applicants, the scrutiny applied is notably more intense than that for local buyers. Malaysian banks aim to mitigate potential financial risks by ensuring that foreign buyers have a stable and sufficient economic foundation to fulfill their mortgage obligations. Understanding and preparing for these stringent checks is essential for foreigners aiming to secure financing in Malaysia.

Required Documents

When applying for a mortgage in Malaysia, foreigners must prepare a comprehensive set of documents to support their application. This typically includes a copy of their passport to verify identity and nationality, detailed proof of income which might require validation by the Malaysian embassy to ensure authenticity, and a valid work permit if they are residing and employed in Malaysia.

Additionally, banks may request other supporting documents, which can vary depending on the bank’s specific requirements and the applicant’s financial background. These documents could include bank statements, tax returns, and proof of legal residence in Malaysia. Each document plays a crucial role in illustrating the applicant’s financial stability and ability to meet loan obligations, making meticulous preparation essential for a successful application.

Interest Rates

The interest rates on mortgages for foreigners in Malaysia tend to be higher compared to those available to local buyers. This discrepancy arises because lenders view loans to non-citizens as having a higher risk profile. As a result, foreign property buyers should diligently shop around at various banks to compare the different mortgage terms available.

Negotiating these terms is also a crucial step, as even slight variations in interest rates can significantly affect the total repayment amount over the duration of the loan. Engaging with multiple financial institutions allows foreign buyers to secure the most favorable conditions, potentially saving considerable sums of money in the long term.

Challenges and Tips

While obtaining a mortgage as a foreigner in Malaysia is indeed feasible, prospective borrowers can anticipate facing several challenges. The complexities primarily stem from more stringent eligibility criteria set by banks for non-residents. Foreigners are generally required to navigate higher down payment requirements and cope with lower loan-to-value ratios than their local counterparts. Additionally, the approval process can be prolonged due to thorough financial background checks that assess creditworthiness, income stability, and existing debt levels more rigorously.

These financial checks often demand a broader array of documentation, including verified income statements from abroad, which can complicate and extend the application process. Understanding and preparing for these obstacles is crucial for successfully securing a mortgage in Malaysia as a foreign national.

Here are several challenges that an expat might face:

Complexity in Documentation

The mortgage application process for foreigners in Malaysia is complicated by the extensive documentation required. Applicants must gather a diverse array of documents, including financial statements, proof of income, and personal identification like passports. Crucially, many of these documents, especially those issued overseas, must be officially translated into Malay or English and subsequently verified to meet the standards of Malaysian financial institutions.

This translation and verification process not only adds a layer of complexity but also extends the timeline for loan approval. The meticulous scrutiny of these documents ensures compliance with local banking regulations but can pose significant challenges for foreigners unfamiliar with the system.

Longer Approval Times

The mortgage approval process for foreigners in Malaysia typically takes longer than it does for local residents, primarily due to the extra layers of verification required. Lenders perform extensive checks on international credit histories, income verification from abroad, and legal documentation, all of which contribute to the extended timeframe. Additionally, foreign applicants face the challenge of currency risk.

If your income is denominated in a currency other than the Malaysian Ringgit, fluctuations in exchange rates could significantly impact your loan repayment amounts. Such variability can increase the financial burden on the borrower if their home currency depreciates against the Ringgit, leading to higher effective monthly payments. Understanding and managing these risks is crucial for foreigners navigating the Malaysian mortgage landscape.

Tips for Success

Engaging with local experts is strongly advised for foreigners interested in purchasing property in Malaysia. Working with real estate agents and lawyers who specialise in transactions involving foreign buyers can significantly streamline the complex process. These professionals are well-versed in navigating the specific legal and regulatory requirements that apply to non-residents, including those pertaining to property ownership limits, financing options, and necessary governmental approvals.

They also provide valuable insights into the local market conditions, helping to identify the best investment opportunities and ensuring all due diligence is properly conducted. Leveraging their expertise can prevent costly mistakes and facilitate a smoother, more efficient property acquisition process.

Compare Different Banks

When seeking a mortgage in Malaysia, it’s crucial not to settle for the first financing offer you receive. Each bank may present differing terms, interest rates, and loan structures, making it essential to explore a variety of financial institutions to find the most favourable conditions. Comparing offers from different banks can reveal significant differences in terms of repayment periods, fees, and flexibility, which could have substantial impacts on your overall financial commitments.

Thoroughly researching and negotiating with multiple banks can lead to more competitive rates and terms that better suit your financial situation and investment goals. This approach ensures you secure the best possible mortgage deal, saving you money and providing greater financial security in the long term.

Consider Legal Restrictions

When planning to purchase property in Malaysia, it is imperative for foreigners to thoroughly investigate any legal restrictions on foreign ownership that may apply in the specific state where they wish to buy. Each state in Malaysia can have different rules regarding foreign property ownership, including restrictions on the types of properties that can be acquired, minimum purchase prices, and specific areas where foreigners are either allowed or prohibited from buying.

Ensuring compliance with these state-specific regulations is crucial to avoid legal complications. Consulting with a knowledgeable local real estate lawyer can provide invaluable guidance, helping to navigate these legal landscapes effectively and prevent potential setbacks in the property acquisition process. This careful scrutiny ensures that all legal parameters are met, securing a successful investment.

Conclusion

The opportunity for foreigners to secure a home loan in Malaysia is certainly accessible, yet it is accompanied by unique challenges and stringent regulations. Foreigners must navigate a complex legal landscape, which includes varying state-specific restrictions on property ownership and loan eligibility criteria. Adequate preparation is essential, involving a thorough understanding of these legalities and securing appropriate financial documentation.

Additionally, having the right support from experienced local real estate professionals and legal advisors can significantly simplify the process. As Malaysia remains an attractive hub for international investors and expatriates, understanding these nuances is crucial. With the right approach and detailed knowledge, the Malaysian property market continues to offer a promising investment landscape for foreigners looking to invest or settle in the region.

The post Can expats get mortgages in Malaysia appeared first on RealestateMY.

]]>The post The Property Buyers Journey appeared first on RealestateMY.

]]>There are many different views on how a person buys a property, and navigating the diverse landscape of purchasing a property reveals a many perspectives that vary significantly among the key players in the industry. Property developers, with their insider knowledge and strategic interests, offer one view. Real estate agents, bridging the gap between developers and potential buyers, present another view, reflected in negotiation and matchmaking. And then there’s the most critical viewpoint of all: that of the property buyers themselves.

Each buyer’s journey is unique, taking into account their personal desires, needs, and financial considerations, yet there’s a common trajectory most follow. In this article, we’re diving deep into the intricacies of the property buying process. We’ll go deep into each of the phases and stages a buyer goes through, aiming to shed light on their thought process and decision-making criteria at every pivotal moment. Certainly, the journey to homeownership can be aligned with the classic phases of the consumer decision-making process, each with its distinct timeline and emotional landscape. Come let’s explore:

Discovery Phase

The Dreaming (3-6 months)

This is the inception, where peoples desire for a home of their own are realised. Over these months, buyers often find themselves saving more aggressively, sacrificing short-term pleasures for their long-term vision. They imagine the number of rooms, the layout, and the life they’ll live there. It’s a period marked by daydreams and occasional doubts as they question when and if they can make this step in life.

During the dreaming stage, the discovery phase unfolds subtly. Potential buyers may not even be actively searching, but the idea of owning a home is becoming increasingly attractive. They notice social media ads, online content about property projects & property guides, they will check out real estate websites out of curiosity, and they start to pay closer attention to friends’ property buying stories.

Research Phase

The Planning (1-2 months)

Planning is where dreams become a goal. Buyers spend evenings going over their finances, on their laptops with bank statements and budgeting apps. They discuss about what they can afford and where they can compromise. It’s here they commit to the journey ahead, setting goals and establishing timelines to make a purchase.

As they progress into planning, buyers enter a full-fledged research phase. Here they will go into the details: from understanding mortgages to investigating locations. It’s a time for learning and for formulating a clear picture of what they want versus what they need. They may attend home buying seminars or spend countless hours online comparing properties and reading up on real estate market trends.

The Searching (2-3 months)

Looking at properties intensify as buyers go through listings, visit show rooms, and speak to real estate agents. They might start with a wide net, considering various locations and styles, but as months pass, they sharpen their focus. They experience moments of disappointment when homes don’t meet expectations, and pleasure when they find properties that do.

Consideration Phase

The Contemplating (1-2 months)

Now, this is the emotional part of the process. Buyers assess their top choices, weighing the pros and cons. Sleepless nights are common as they envision their life in each space, from cooking in the kitchen to relaxing in the lounge It’s a mixture of practicality, as they consider commute times and school districts, price and emotion.

In the searching stage, buyers are in the heart of the consideration phase. They’ve identified potential properties that fit their criteria and now begins the process of evaluating each option. They’ll carefully inspect each property, sometimes visiting multiple times, imagining their life in each room and discussing the potential of each property with family and friends.

Decision Phase

The Securing (1 month)

The contemplation stage mark the beginning of the decision phase. The buyer has likely narrowed their options down to one or two properties and must now make the tough decision of which to commit to. This stage is characterised by intense emotion; it’s a pivotal point in the journey where dreams are either realised or reconsidered.

Post-Decision Phase

The Anticipating

The final countdown is both thrilling and nerve-wracking. Buyers begin to make concrete plans, like hiring movers and enrolling children in new schools. It’s a mix of mundane tasks and bursts of creativity as they start picturing their life in the new home. They often lie awake, imagining painting walls and hosting dinners, even as they fret over the details of the move.

The Realising

Finally, the anticipating stage aligns with the post-decision phase. Although the decision to purchase the property has been made, this phase involves the buyer reassuring themselves that they made the right choice. They might seek validation from friends and family and begin to plan the move in detail. The months of searching and contemplating reached in this moment, where the dream of property ownership becomes a reality. It’s a time of emotional release and joy as the buyer officially becomes a new property owner.

Conclusion

Each phase in this journey is integral to the buyer’s experience and understanding this timeline is essential for people in the property industry. By understanding the emotional journey of the buyer and providing support through each phase, property professionals can build a strong, trusting relationship with their clients that lasts well beyond the purchase date.

For all property professionals, it’s essential to understand each step’s emotional weight and time investment. This isn’t just a transaction; it’s a life-changing journey that deserves patience, respect, and a profound understanding of the buyer’s experience.

By understanding the buyers emotional journey, property professionals can craft customised marketing strategies that nurture potential property buyers, into a loyal client base.

The post The Property Buyers Journey appeared first on RealestateMY.

]]>The post Best Place To Stay In Mutiara Damansara appeared first on RealestateMY.

]]>Mutiara Damansara is like that cool friend who knows how to live it up—trendy, vibrant, and smack in the middle of fun and convenience. It’s where you can find yourself lost in the mega retail paradise of The Curve, only to stumble upon the latest blockbuster at IPC Shopping Centre’s cinema, or get your tech fix at the colossal IKEA. The best place to stay here? It’s not just about the bricks and mortar; it’s about being at the heart of action, wrapped in comfort.

Imagine living in a spot where every weekend could be a staycation, with the buzzing nightlife of PJ just a stone’s throw away, yet your peace and quiet is undisturbed. From chic studios to sprawling condos, Mutiara Damansara offers a lifestyle tailored for those who crave the excitement of city life but cherish their moments of solitude. Let’s dive into this dynamic neighborhood and find out why it’s not just a place to stay, but a place to live life to the fullest.

Top Place To Stay In Mutiara Damansara

Reflection Residence, Mutiara Damansara

Reflection Residence is a serviced condominium located within the thriving hub of Mutiara Damansara. The condo is developed by Glomac AL-Batha Mutiara Sdn Bhd. It neighbors similar developments such as Pelangi Damansara, Ritze Perdana 1, and Surian Condominiums.

Reflection Residence is a freehold condominium that comprises of a 39-storey building which houses a total of 299 units. Units here come in varying sizes ranging from 1,092 sf to 1,705 sf. Each of these units typically come with 3 bedrooms and 2 bathrooms. Residents are able to enjoy a wide range of resort-like facilities as well.

Hovering of The Curve, residents of Reflection Residence are able to enjoy a wide range of amenities within close proximity. Within a 1km radius, residents have an easy access to many popular spots including IPC, Ikea, Tesco and 1-Utama. Apart from that, a short-drive along Persiaran Surian towards Kota Damansara will bring commuters to Sunway Giza Mall which is host to an abundance of amenities, with many pubs and bars as tenants. Carrefour and Giant can be found nearby as well.

Mutiara Homes, Mutiara Damansara

Mutiara Homes is an exclusive gated and guarded residential enclave nestled in the affluent township of Mutiara Damansara. It is surrounded by lush greenery as well as superb amenities. It is part of the Mutiara Damansara development by Boustead Properties on the 360-acre freehold land.

Mutiara Homes was launched back then in November 2000 using balloting system. The residential comprises 461 of 2-storey terrace houses, 40 units of 2-storey semi-detached and 18 units of 2-storey bungalow. Besides that, there are 10 units of 2-storey shop office lot to serve the residents.

Residents of Mutiara Homes are pampered with fantastic amenities right from front of their doors. It is surrounded by plenty amenities, such as shopping malls, police station and a recreational park. Undoubtedly, Mutiara Damansara is well-known for its shopping centres – The Curve, e@Curve (formerly known as Cineleisure Damansara), Ikano Power Centre (IPC), IKEA and Tesco Damansara.

Mutiara Hill, Mutiara Damansara

Mutiara Hills is an exclusive bungalow estate located in the affluent township of Mutiara Damansara. It comprises of only bungalow units and is situated right in between Mutiara Homes and Ritze Perdana 2.

Mutiara Damansara is surrounded by affluent and established neighborhoods such as Taman Tun Dr Ismail, Bandar Utama, and Damansara Utama. Also, it also neighbors one of the most vibrant townships in Petaling Jaya – Damansara Perdana, Kota Damansara and Bandar Utama.

Residents of Mutiara Hills are served with a vast array of shopping centres, shops, grocers and a recreational park within the enclave – which are mostly within minutes by foot. Mutiara Damansara is a well-known area for its shopping centre hub which it consists of The Curve, Ikano, Tesco Damansara, IKEA, and e@Curve. Besides that, there are rows of shops, restaurants and beauty centres nestled nearby Mutiara Hills as well. There is also a proposed school to be developed in the area as well.

There are plenty of amenities offered in surrounding neighborhoods, such as golf clubs (Tropicana Golf & Country Resort and Bandar Utama 9-hole Golf Course), a driving range (Bandar Utama Golf Driving Range) and sport centre (The Club @ Bukit Utama). Not only that, if the shopping centres within Mutiara Damansara are not satisfying enough, residents can drive to 1 Utama Shopping Centre, Tropicana City and Giant Kelana Jaya which are reachable within minutes.

Desa Mutiara Apartment, Mutiara Damansara

Desa Mutiara Apartment is a medium cost apartment located in the vicinity of Petaling Jaya, in Mutiara Damansara Selangor. This residence was developed several years ago on a freehold land for the medium income citizens. This is a walk-up apartment as there are no lift services available and a total of eleven blocks are offered which has 5 storeys each. This low rise apartment provides a sum of 330 units.

Desa Mutiara Apartment comes with a single layout which has 760 sf built-up and all units in this residence have 3 bedrooms and 2 bathrooms. There are also several facilities available in this vicinity and among them are restaurants, mini market, children’s playground, jogging track, car park, as well as 24-hour security to keep this residence safe and secured.

As for the amenities, Desa Mutiara Apartment is located closely to SMK Damansara Jaya, SMK Damansara Utama, Plaza Damansara Utama, Tropicana City Office Tower, Tropicana City Mall, KDU, KLGCC Bukit Kiara, Oasis Ara Damansara, The Curve, Ikea, One Utama, KPJ Damansara, One World Hotel, Sunway Giza, Carrefour Hypermarket, Saujana Golf Resort, KBU and Tropicana Golf and Country Resort.

Surian Condominiums, Mutiara Damansara

Surian Condominiums (also known as Surian Condominium) is a low density condominium development located in Mutiara Damansara enclave. It is developed by Boustead. It is easily accessible from Persiaran Surian that connects to Lebuhraya Damansara Puchong and also NKVE. Also, you can utilise Penchala Link which is just within short driving distance.

Surian Condominiums comprises of 376 units. Each unit consists of dual entrances, one for the main entrance while another for rubbish path et cetera. Each unit comes with 2 parking bays, side by side.

Mutiara Damansara enclave is mushroomed with plenty of commercial and shopping centers. It is the home to The Curve, IKEA, Tesco, IKANO, Cineleisure Damansara, Courts Megastore, Proton Platinum Showroom, Lexus showroom, and UAC’s head office. Therefore, from buying yourself a new car to buying groceries and household necessities, and from having a karaoke session with friends to watching movie at the cinema with your love ones, you can always have them all without leaving the enclave.

Pelangi Apartment, Mutiara Damansara

Pelangi Apartment is a leasehold apartment situation along Persiaran Surian in Mutiara Damansara. It is neighbors with many similar developments such as Opal Damansara, Flora Damansara and Casa Damansara 1. It have 19-storey tall buildings that offer apartment units with built-up sizes ranging from 674 sf to 1,180 sf.

Each units come generally come with 3 bedrooms and 2 bathrooms, although there may be slight variations between units. Facilities available to residents include covered parking, mini market, playground, sauna and 24-hour security. It is situated within close proximity to many amenities. Right beneath the apartment, there are several shop lots like House Depot and Club 29, while a short drive along Persiaran Surian will bring you to The Club which is host to recreational activities like paintball, and a famous restaurant that serves authentic Chinese food.

The post Best Place To Stay In Mutiara Damansara appeared first on RealestateMY.

]]>The post Best Condo In Sri Hartamas appeared first on RealestateMY.

]]>Sri Hartamas, with its eclectic mix of international cuisines, bustling markets, and a vibrant community vibe, is the kind of place that quickly turns visitors into locals. Nestled in this lively neighborhood, the best condos aren’t just about luxury living; they’re your entry ticket to an exclusive lifestyle where convenience meets chic urban living.

Imagine stepping out of your door to the aroma of fresh pastries from artisan bakeries, spending your afternoons exploring quaint boutiques, and capping off your evenings at rooftop bars with stunning city views. Not to forget, you’re just a hop, skip, and jump away from iconic landmarks like the National Palace and the sprawling greens of Bukit Kiara Equestrian Club. Sri Hartamas’s condos are more than just homes; they’re your personal havens amidst the hustle and bustle, offering a slice of tranquility with a dash of city sparkle. Let’s uncover the gems of Sri Hartamas, where every day is an adventure waiting to happen.

Top 10 Condos In Sri Hartamas

The Signature, Sri Hartamas

The Signature is a boutique development located on a freehold land at the heart of vibrant Sri Hartamas near established commercial hubs such as Mont Kiara and Damansara Heights.

The Signature comprises of 2 blocks; Block A is a 11-storey tall building which houses SOHO units while Block B is a 9-storey tall building comprising of service suites. There are a total of 336 units, of which 216 units are SOHO units while the remaining 120 units are made out of service suites.

There are a wide variety of layouts available with built-up sizes ranging from 421 sf to 1,014 sf which typically comes with either 1 or 2 bedrooms. One car park bay is provided for single bedroom units while 2 bedroom units will have 2 car park bay allotted.

Residents of The Signature are able to enjoy a wide array of facilities conveniently located within minutes from their doorsteps. Basically all sorts of entertainments, amenities as well as eateries can be obtained within a short drive.

The thriving Plaza Mont Kiara is an ideal location to acquire necessities as it is practically just around the corner. For more options, residents will have the option to head over to either one of the thriving commercial hubs within the vicinity.

The advantageous location of The Signature provides families students with a peace of mind as Mont Kiara has several prestigious schools such as Garden International School and MK International School.

Sunway Palazzio, Sri Hartamas

Sunway Palazzio is an award winning development by Sunway City Berhad located in Sri Hartamas enclave. It is the 1st high rise residential development in Malaysia to be awarded BCA Green Mark Gold Award.

Also, the property was crowned as the winner in the category of Best High Rise Residential Development in Malaysia in the 2009 Asia Pacific Property Awards which sponsored by CNBC Television. Sunway Palazzio comprises 2 tower blocks that house a total of 160 units. There are 3 to 5 units per floor on Level 2 until 19. There are 4 basement floors for car park. Facilities and lobby are located on the ground floor and the infinity pool deck is located at the highest floor. The development is scheduled to be completed in April 2010.

The first launch of Sunway Palazzio was held in Singapore in April 2007. It was priced at RM846 psf, with the smallest unit tagged at RM2.1 million. The price has set a new benchmark for Mont Kiara and Sri Hartamas vicinity. The developer claimed that they managed to sell 30% from the total units in Tower 1 during the launch in Singapore.

Besides Singapore, the developer also marketed Sunway Palazzio in Hong Kong and Indonesia as well. The developer offered two package options to initial buyers, the first package is a deferment plan, which initial buyers only need to pay 20% for down payment and nothing else until handover, and another is rental guarantee, which the developer promised 7% gross ROI for the first 2 years for 30 selected units.

Carlton, Sri Hartamas

Carlton (also known as Carlton @ Plaza Damas 3) in Sri Hartamas is part of the Plaza Damas 3 mixed-commercial development. It is part of the last phase for the Plaza Damas area. It is just across the road from the Hartamas Shopping Centre. Those who have been interested in the Plaza Damas area will know that Carlon is situated where the sales office and show units for their other properties were.

Originally launched on the 3rd of April 2009 by Mayland Universal, Carlton came with several benefits such as 6% guaranteed return rate of investment for 2 years, a 10% cash rebate – all on exclusive freehold land. It is important there are 3 blocks of units in this phase, one of which is Carlton. This block has 185 units, but in total phase 3 has 595 units. The units here are mostly studio apartments with a long and narrow design with an area of either 500 sf or 595 sf. Like any other typical studio apartment, it has the bare minimum living area. That is, when you open up your front door, there is the kitchen, living room, bedroom, and a balcony.

Menara Hartamas, Sri Hartamas

Menara Hartamas is a low density freehold condominium located in Sri Hartamas, a sought after address in Kuala Lumpur. It is another property development by Mayland. It comprises of a 10-storey tower condominium block that consists of 136 condominium units. Each unit comes with 3 to 5 bedrooms and 2 to 5 bathrooms. Built-ups start from 1,560 to 3,250 sf.

Menara Hartamas is located strategically within walking distance to Hartamas Shopping Center and SK Seri Hartamas. There are numerous commercial activities within short distance, as Plaza Damas is also located within short walking distance, as well as the new Plaza Damas 3. Being located besides the “Global Village” Mont Kiara, expatriate occupants can send their kids to numerous international schools in the vicinity namely Garden International School, Sri Cempaka International School and Mont Kiara International School within short driving distance. Plus, Menara Hartamas is also nearby Taylor’s College.

There are plenty of road and highway accesses available within Sri Hartamas. For instance, one can utilize its direct access to Jalan Duta to reach Jalan Kuching and head to the city center. Also, one can use PLUS highway to head north via Jalan Duta. Alternatively, SPRINT highway is also adjacent to Sri Hartamas that leads to Damansara Heights, Bangsar and Damansara. Furthermore, it is also nearby Penchala Link, Duke Highway and Kerinchi Link.

Windsor Tower, Sri Hartamas

Windsor Tower is a serviced apartment located beside Hartamas Shopping Centre and Plaza Damas, along Jalan Sri Hartamas 1. It is also located next door to Waldorf Tower, Mayfair and Puncak Prima.

Windsor Tower is a single 28-storey apartment block building which comprises a total of 446 units. Units available measuring from 500 sf to 1,735 sf. There are several facilities provided by the developer, which include swimming pool, gymnasiums, games room, business center, spa pool, sauna and squash court.

Living in Windsor Tower, residents can access plenty of amenities just besides the building. There are plenty of eateries spots including chic cafes and bars residing in Plaza Damas and Hartamas Shopping Center.

Not only that, Windsor Tower is also within short driving distance to Desa Sri Hartamas commercial center which packed by rows of clubs, bars, fancy restaurants and boutiques. There is also True Fitness located in Desa Sri Hartamas as well. The serviced apartment is also near to Wilayah Mosque as well as government complexes at Jalan Duta.

Mayfair, Sri Hartamas

Mayfair is another studio serviced apartment located within Plaza Damas vicinity. It was developed by the infamous Mayland, a developer based in Hong Kong that has also developed numerous developments medium to high end residential, as well as commercial developments. Its residential projects include Dorchester, Sri Putramas I, and Waldorf Tower. It is also the same developer for Sri Hartamas Shopping Center.

Mayfair is one of the favorites residential for expatriates and long-term business persons. Most residents take advantage of its positioning in Plaza Damas vicinity which residents can walk to office. Not only that, it is also a great residential for Taylor’s student as the college is just located within short walking distance. Not only that, residents are catered with numerous amenities available as Sri Hartamas Shopping Center offers several options of eateries as well as housing fashion boutiques, health and beauty products, electronic stores, lifestyle sores and supermarket.

Dorchester, Sri Hartamas